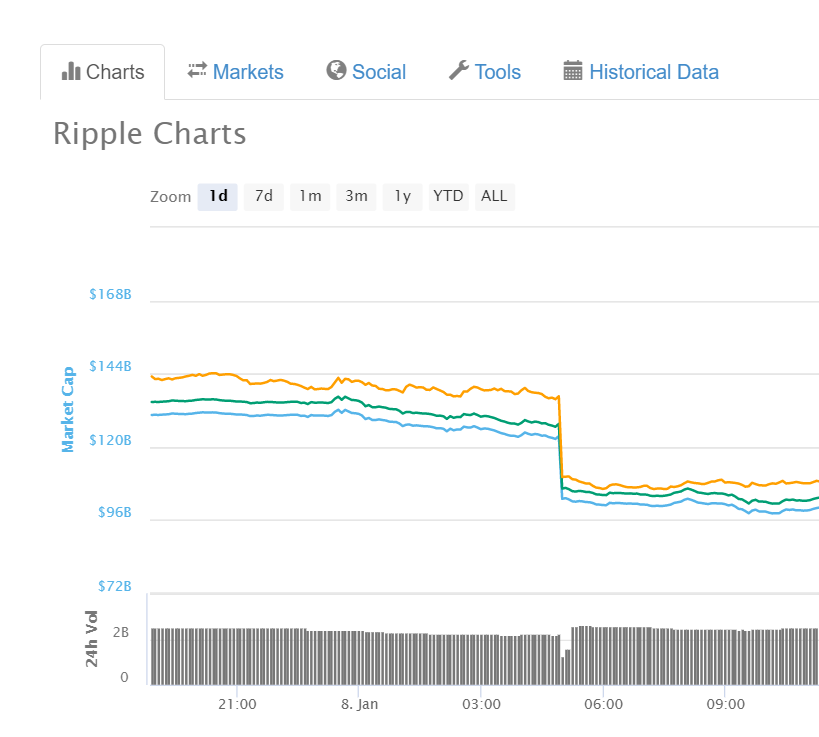

CoinMarketCap, arguably the most prominent global index of cryptocurrency prices, triggered a wave of anxiety and anger this morning when it removed a group of Korean cryptocurency exchanges from its price calculations.Though the change was apparently made at midnight Sunday U.S. EST, CoinMarketCap did not publicize it until midday on Monday, saying that the Korean exchanges showed “extreme divergence in prices from the rest of the world and limited arbitrage opportunity.” This morning we excluded some Korean exchanges in price calculations due to the extreme divergence in prices from the rest of the world and limited arbitrage opportunity. We are working on better tools to provide users with the averages that are most relevant to them. — CoinMarketCap (@CoinMarketCap) January 8, 2018The move resulted in a sharp drop in CoinMarketCap’s measurement of nearly all cryptocurrencies. That gave the impression that a broad market decline, already in progress, had become even more dramatic overnight. As news of the cause for the sharp drop spread Monday, most cryptocurrency prices began recovering losses.

Source: Major Cryptocurrency Index Excludes Korean Prices Without Warning | Fortune