It’s no secret that Opera isn’t doing so well in the era of Chrome dominance. According to a report published by Hindenburg Research, the company’s losses in browser revenue have apparently led it to create multiple loan apps with short payment windows and interest rates of ~365-876%, which are in violation of new Play Store rules Google enacted last year.

You may recall that Opera became a public company in mid-2017, shortly after it was purchased by a China-based investor group. Since then, Opera’s market share has continued to fall, due to the increasing dominance of Chrome. As a result, Opera decided to pivot to predatory short-term lending in Africa and Asia across four apps: OKash and OPesa in Kenya, CashBean in India, and OPay in Nigeria.

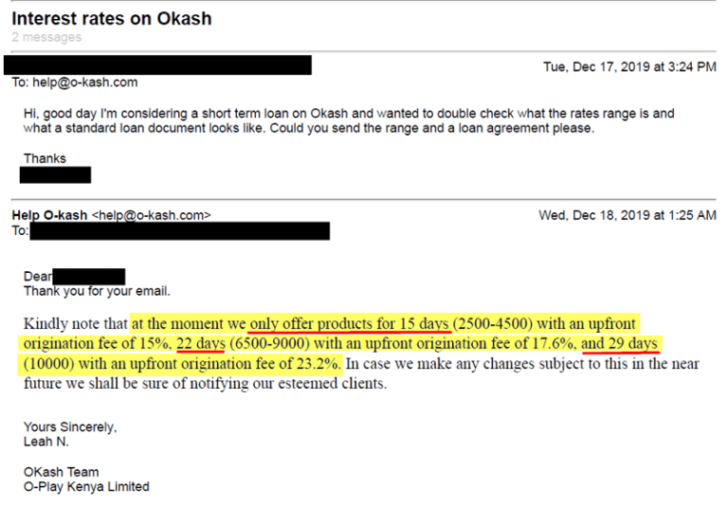

The apps have apparently remained available in the Play Store (except OPesa, which seems to be gone) by advertising different loan rates in the app description than users actually receive. For example, the listing for OKash stated its loans range from 91-365 days (the page now says 61-365 days), but an email response from the company stated it only offered loans from 15-29 days — significantly lower than the 60-day minimum enforced by Google. All of Opera’s other apps were also found to be in violation to varying extents.

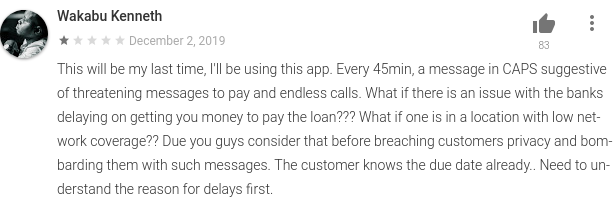

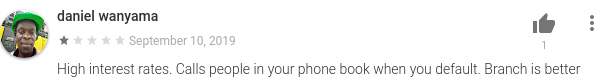

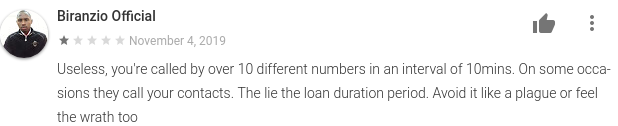

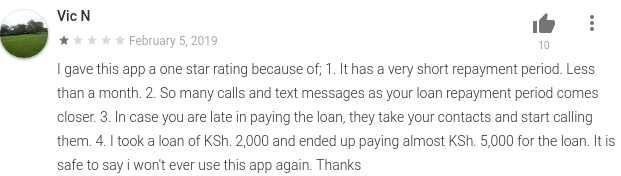

If you think that’s bad, then buckle in! According to Play Store reviews, the OKash and OPesa apps sent text messages or calls to people in the user’s contacts when payments were late, threatening to take legal action or place the borrower on a credit blacklist. A former employee told Hindenburg Research that this practice ended last year “because it was said it was illegal.” That’s probably a good reason to stop doing something, right?

Play Store reviews on OKash

Unfortunately for Opera, scamming low-income people isn’t helping the company’s financial situation. With all apps in violation of Play Store policies (and one already removed from the store), Opera’s primary means of income could very well disappear, and Hindenburg Research found evidence of investor money possibly being redirected to other companies and people:

1. $9.5 million of cash went toward an entity that appears to have been owned 100% by Opera’s Chairman/CEO, despite company disclosures suggesting otherwise. Ostensibly, the reason for the payment was to ‘purchase’ a business that was already funded and operated by Opera. To us, this transaction simply looks like a cash withdrawal.

2. $30 million of cash went into a karaoke app business owned by Opera’s Chairman/CEO, days before the arrest of a key business partner.

3. $31+ million of cash was doled out for “marketing expenses and prepayments” to an antivirus software company controlled by an Opera director and influenced by Opera’s Chairman/CEO. The antivirus company has no other known marketing clients, but is paid to help Opera with Google and Facebook ads and other marketing services. (Note: Most firms use a marketing agency for help with marketing needs.)

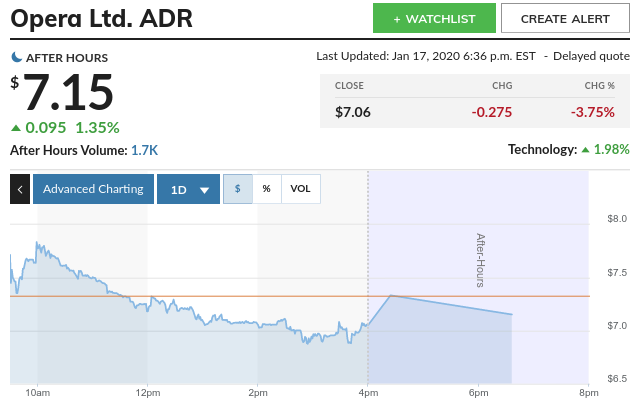

Since the report was released on January 16th, Opera’s stock price has dropped from ~$9 to $7.15 after hours (as of the time of writing).

You can read the full report at the link below. In the meantime, it might be a good idea to uninstall any Opera-owned apps — they might start sending texts to your friends about your browsing habits.

- Source:

- Hindenburg Research

Robin Edgar

Organisational Structures | Technology and Science | Military, IT and Lifestyle consultancy | Social, Broadcast & Cross Media | Flying aircraft