Abstract: This report assesses the impact disclosure of data breaches has on the total returns and volatility of the affected companies’ stock, with a focus on the results relative to the performance of the firms’ peer industries, as represented through selected indices rather than the market as a whole. Financial performance is considered over a range of dates from 3 days post-breach through 6 months post-breach, in order to provide a longer-term perspective on the impact of the breach announcement.

Key findings:

While the difference in stock price between the sampled breached companies and their peers was negative (1.13%) in the first 3 days following announcement of a breach, by the 14th day the return difference had rebounded to + 0.05%, and on average remained positive through the period assessed.

For the differences in the breached companies’ betas and the beta of their peer sets, the differences in the means of 8 months pre-breach versus post-breach was not meaningful at 90, 180, and 360 day post-breach periods.

For the differences in the breached companies’ beta correlations against the peer indices pre- and post-breach, the difference in the means of the rolling 60 day correlation 8 months pre- breach versus post-breach was not meaningful at 90, 180, and 360 day post-breach periods.

In regression analysis, use of the number of accessed records, date, data sensitivity, and malicious versus accidental leak as variables failed to yield an R2 greater than 16.15% for response variables of 3, 14, 60, and 90 day return differential, excess beta differential, and rolling beta correlation differential, indicating that the financial impact on breached companies was highly idiosyncratic.

Based on returns, the most impacted industries at the 3 day post-breach date were U.S. Financial Services, Transportation, and Global Telecom. At the 90 day post-breach date, the three most impacted industries were U.S. Financial Services, U.S. Healthcare, and Global Telecom.

The market isn’t going to fix this. If we want better security, we need to regulate the market.

Source: Security Breaches Don’t Affect Stock Price – Schneier on Security

However, the dataset:

The analysis began with a dataset of 235 recorded data breaches dating back to 2005

is very very small and misses some of the huge breaches such as Equifax.

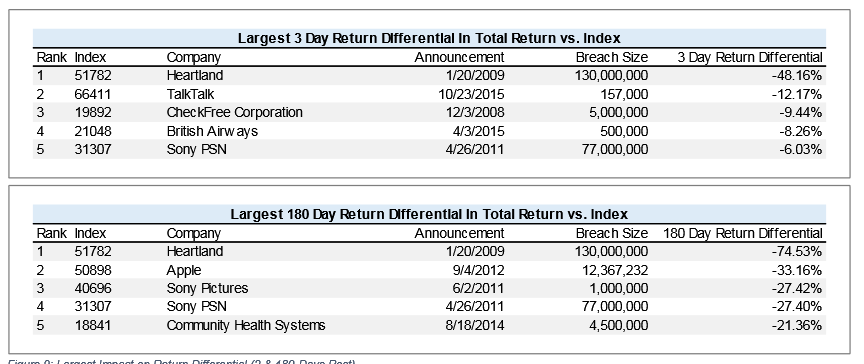

There is a very telling table in the results that does show that if a breach is hugely public, then share prices do indeed plummet:

So it may also have something to do with how the company handles the breach and how much media attention is out there.

Robin Edgar

Organisational Structures | Technology and Science | Military, IT and Lifestyle consultancy | Social, Broadcast & Cross Media | Flying aircraft